QLD has upset a few property investors!

This is Aus Property Investors - We’re the newsletter you lean on for all your property news! You can lean on us like Michael Jackson in Smooth Criminal.

This Month’s Run Down:

🤑 What does this new land tax mean for me?

🏘 How the lending rules affect your ability to grow a portfolio?

💰 How to add $40 a week in rent!

🧑💻 An accountants guide to making money

🧰 FREE QLD TAX CALCULATOR

Tax The Rich, But Don’t Tax Me!

Queensland has been the investment wonderland over the past few years and many fortunes have been made.

Now, the government is looking to capitalise on the everyday investor with what can only be described as a “cash grab”.

We’re not ones to diss the government, but to be honest, we’re struggling to find another phase that suits the situation.

However, it’s a smart move!

How would you bring in revenue for your state without taxing or upsetting the people that are going to vote for you?

Well, tax the people that aren’t in your state and won’t have a chance to vote for you.

Tax the out-of-state property investors!

Well played Annastacia Palaszczuk. It’s bloody genius, but it’s not bloody right!

This newseltter will set it all straight so you know what this means for you and your bottom line.

For The Newbies

Happy Sunday, and a very warm welcome to all the new subscribers! We’re thrilled and honoured to have you as readers and truly appreciate your thoughts and feedback 🙏.

Each edition of this newsletter will contain a deep dive into the property experts, investors and all-around legends that grace us with their time and energy for the Facebook lives we run in our Facebook Group Aus Property Investors.

For those that need a catch-up when they aren’t free for an hour [or sometimes 2] at 7:30 pm Wednesday night (we know we’re not), we created this newsletter, along with recording the sessions on our Youtube channel.

If this has any value for you at all, feel free to share and forward this newsletter with a friend!

That helps us a lot in bringing the bests guests Australia has to offer!

June Live Guests!

Michael Xia

Michael is an award-winning mortgage broker and active property investor. Together with his wife, they share a portfolio of 39 properties across NSW, QLD and WA.

From purchasing his first property at age 21, and with some ups and downs along the way, Michael accumulated a property portfolio of 14 properties by age 30. It was then he was able to quit his corporate job in market research to pursue his interest in the property. More specifically, his interest in helping other investors generate passive income and achieve financial freedom through property investing as a mortgage broker.

Joe: “How many properties do you think you think you would own if you started now with the new lending rules”?

Michael: Hard to say, there are so many variables in that, you would have tt someone to model that out for you. If say for instance you took my same scenario, I’ve got a young client at the moment, he’s in his 20’s, salary of about $70,000, he is rent-vesting, he started with me buying his first property about 2 years ago and is just now settling his fifth property. I think they could probably get another 1 or 2 more.

Joe: And What’s the value of them?

Michael: They’re all about $300,000 - $400,000, his first was a property in Sydney [unit], 2 properties in Logan and now he’s buying in Perth [has two]. It doesn’t have to be in those areas but this is an example, by all means living at home / rent-vesting all helps, along with buying property with a decent rental return.

There are lots of Gold Nuggets on how to grow a sizeable Property Portfolio in this session, check out more of this investing masterclass below!!

Jason Wright

Jason has a wealth of experience in property management, business development and portfolio management, with a passion for cash flow positive investment strategies.

Jason is fully qualified in Commercial Property Management, leasing and sales and has 11 years experience across all faucets including, Industrial, Commercial & Retail. Additionally he is an award winning professional focused on self development and developing others. He has a passion for helping investors with their property portfolios along with building his own property portfolio and we saw this shine through in the live session we did with him.

Jason: I’ve talked about buying old houses that need renovating and my other big thing is I love buying houses with sheds that have some kind of “add on” space, if there’s a shed that’s partially lined to spend $5K on putting in some fresh floor coverings, fresh paint, split system air-conditioning so that it can be advertised as a studio / possible 4th bedroom / teen retreat will add $30 to $40 per week. You can then have this paid back in 2 to 3 years, it’s a bargain!

Other ways to add value to your property are, when you’re looking at big homes, there’s a possible way to turn one of the rumpus rooms into a fourth bedroom, again generating $30 to $40 per week extra in rent, generating nothing as a 2nd living room. A double garage is better than a single one and if you have that double garage spend the extra money on getting it electrified, which will attract a “better” tenant.

As you can tell we covered plenty speaking to the “Double Agent” of Property Investing, tune in below to hear more!

Bushy Martin

Bushy is one of Australia’s Top 10 Property specialists, award-winning Mentor Of The Year, author, speaker and sought-after media commentator on all things property and finance.

After achieving his own lifestyle goals through property investment, Bushy and his team have helped 1700+ investors secure more than $600 million in property as a mortgage broker. Given we’re entering into a rising interest rate environment we wanted to get him on to talk shop and understand his vast experience investing all types of market conditions.

Joe: “How much does a rate increase affect mortgage repayments”?

Bushy: Good question and there’s another unanswered question there in terms of how far will they rise and when will that stop? Depending on what you read, there’s a fair chance that because of that “over-correction” [of interest rates rising] it might see a quick rise of rates in the short to medium term and in the later part of next year there’s a mutter of rates starting to come down again. To your question though Joe, the average mortgage at the moment is a touch under $600K, so on a mortgage of this size, on a 0.1% interest rate increase the mortgage goes up $8 a week or $34 a month.

There was a lot of gold in this episode that spoke to Rising interest rates along with how to build a recession proof Property Portfolio. Check these gems out below!

Aaron Whybrow

Aaron is the “Bagpiping Mortgage Broker”. Unlike other mortgage brokers, Aaron is not “Flat” as there are no “flats” on the bagpipes!

Aaron has enjoyed 3 careers in his life, and the learnings and skills from these have all come together giving you a mortgage broker with different yet highly essential skills. He genuinely goes above and beyond in his own investing journey along with helping his clients to achieve theirs! We spoke to him about how to approach lending from a strategic mindset.

Joe: What is the difference between purchasing power and borrowing power?

Aaron: With purchasing power this is accomodating all of the extra expenses, such as stamp duty, BA fees, legal fees etc. This really comes into it when you’re leveraging off other assets for the deposit to buy the property, pay all the fees and charges that need to be paid. Borrowing power reflects the amount that the lender will allow you to borrow based on your income and expenses.

To Learn More about “The bagpiping brokers strategies to “fight” for your Financial Freedom”, including some epic tips watch this full Live session below

Jeremy Iannuzzelli

With over 12 years of experience, dealing with small to medium business enterprises. Jeremy Iannuzzelli learned to channel his focus in the niche market of property investment.

Dealing with 1000’s of property investors, he is able to create effective tax structures in line with the goals and objectives of his clients. He is the Investment Savvy Accountant, who walks the talk and has built a property portfolio the envy of most investors. You will see he makes an appearance again later in the newsletter as well!

Jef: We’re getting close to tax time, so what are your top tips consider for people when doing their tax?

Jeremy: The main things are making sure that your information is prepared, spend the time [don’t rush to get your tax return done], make sure that you are claiming all of the things that you can, be careful with this though as the tax officer do track, monitor, compare and contrast the items that investors are claiming. Doing this will enable you to ask your accountant about how your cash / non-cash performance of your property portfolio is going.

There is a lot of gold in this “The tips this Investment Savvy accountant uses to grow his Property Portfolio” Episode. Watch this full Live session below for more great value.

QLD Land Tax Grab! 🤑

“Tax the rich investors, screw them, they should be paying more tax!”

Well, yes, they bloody should be!

But this isn’t just affecting the uber-wealthy, it’s affecting the everyday mum and dad investors like you and me.

The challenge is, there is a thing called ‘trickle down economics.

Rather than benefiting renters and the under-served, it’s actually going to put a large burden on them!

Don’t you know we’re in a rental crisis with under 1% vacancy rates?!?!?!

As investors get slugged with more outgoings, they will pass some of these increased expenses onto the tenant and rents will rise.

Worse, the investor may say “I’m out” and sell their property, which would remove it from the renter pool, making the rental stock even tighter.

This means it’s even harder to get a property to rent!

What is it, and how does this new Land Tax work?

High level:

If you ONLY own property in QLD, it’s the same rules as before, no extra tax for you.

If you don’t own property in QLD at all, then you’re not affected.

If you hold an investment property and you do not reach the threshold, you’re not affected.

If you don’t own property at all….. Then what are you doing, buy up baby!? (oh and you’re not affected.)

If you have a large portfolio outside of QLD, then you really need to consider this if you want to buy in QLD!

From the 30th of June 2023, your land tax will be calculated on your entire Australia holdings, not just what you have in the state of QLD.

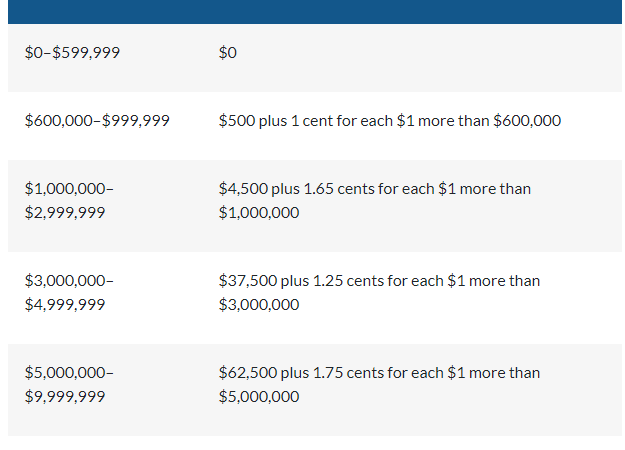

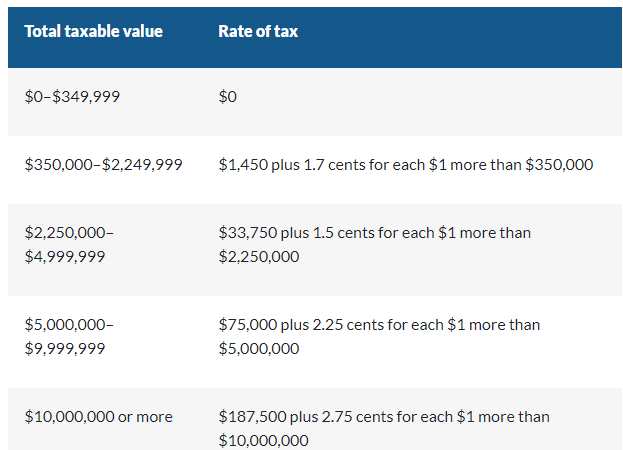

The land tax kicks in for individuals when their land value hits $600,000 or more, while assets in companies and trusts hit a $350,000 threshold. Charts below!

The old rules don’t care what you have invested in other states, it’s none of QLD business and has no relevancy to land tax.

Well, the new rules do and they may end up costing you thousands.

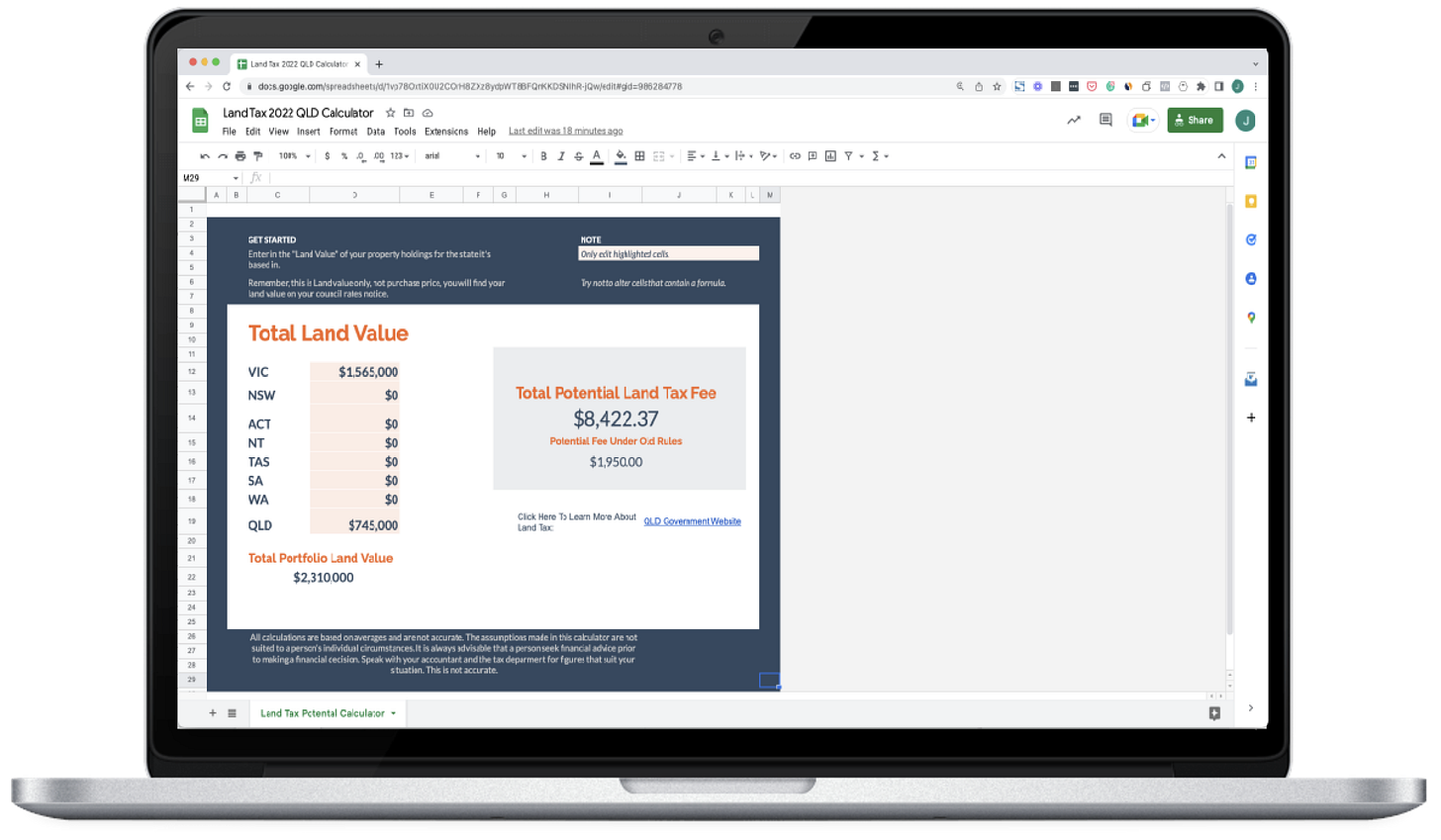

On the Government website HERE they have an example from a lovely lady named Lena. Having an investment property in QLD and VIC, Lena will be slogged with an additional $6,472.

That’s right, Lena only 2 investment properties!

”Lena will receive a Land Tax bill of $1,950 in the 2022 fin year, and only 12 months later that Land Tax bill will rise to $8,422.37”

Damn, sorry Lena, that sucks.

Imagine having your tax bill jump up 3 times!

The true winner here is the QLD Government, but I wonder what this is going to mean long-term for renters and house prices in QLD.

I am already hearing investors saying they are looking at other states to invest in because of this tax.

Now, we’re not saying you shouldn’t buy in QLD, it’s actually an amazing place to invest, but this is a new variable that needs to be taken into consideration for any investor looking there.

Here is the breakdown from the Government website for individuals, companies and trusts.

Individuals Breakdowns

Companies and Trusts Breakdowns

You can read more about land tax essentials on the QLD Government Website.

What Can We Do About It?

For those that are more of a video type of person, Lucky for you, we had the amazing Jeremy Iannuzzelli, Founding Partner and Accountant at KHI Partners sharing amazing insights into what the heck this new tax means.

He ran through some of the way property investors can help protect themselves from some of these crazy rules that come in. Check it out below.

Oh, and don’t forget to Subscribe to the channel HERE

FREE Property Tool Of The Month!

For those that want to know what they are going to be hit with, we created this amazing tool that calculates the potential land tax you may be hit with.

Download this sucker now!

One thing to mention is this doesn’t work on excel.

Sorry.

We are a Google Sheet family here, and you will need a G-Mail account to access this (so many rules!)

Once you have clicked the link below, you will be prompted to “Make a copy”and then the sheet is all yours to play with.

Another thing to note is the tax is charged on the value of the “Land”, not on the value of the entire property.

I can only imagine how many people will enter in there $1,000,000 purchase price when the land component is only $300,000, check your council rates for your land value.

You have been warned!

Now time to see what the numbers are.

This is not financial advice. These numbers are all estimates and not to be relied upon in any manner. Speak with your qualified accountant and tax advisor to help you work out the real numbers for your situation.

🔥 That’s another Month Wrapped up! Thanks for reading Aus Property Investors Monthly. Tell us how we did!🔥