CBD Property Returns: Closer Ain't Always Better.....

What That 'Expert' Property Seminar Never Told You

We’re AUS Property Investors, your investment Sensei, stealthily finding profits in the right markets! (well, we’re no Sensei, but our moves are pretty sharp!)

This Month’s Run Down:

😵💫 The Day I Joined (Almost) a Property Cult

😱 Our Thoughts On Removing Negative Gearing & If It Will Crash Your Portfolio

📗🥳 Key Principles For Building A $150K Passive Income Portfolio

💵 How To Finance Your Own $150K Passive Income Portfolio

🤫🤠 The Truth About Darwin Property

🏙️ CBD Property Returns: When Facts Meet Fiction

🧰 FREE Property Tool Of The Month

The Day I Joined (Almost) a Property Cult

Eons ago (yes, I'm that old), I was as green as they come in the property game. Picture this: wide-eyed, bushy-tailed, and armed with nothing but enthusiasm and a notepad, I found myself at what was advertised as a "life-changing property investment weekend seminar."

Funny story, it was actually one of these seminars that Jef and I met, anyway, I digress!

This one was not that one!

Oh boy, was it life-changing though. 😵💫

You know those high-energy church revival meetings you see in movies?

This was like that, but instead of peddling salvation, they were selling "foolproof" property investment strategies.

The air was thick with desperation and the smell of instant coffee while motivational speakers took turns whipping the crowd into a frenzy.

Every 30 minutes, like clockwork: "Quick! The first ten people to rush to the back will get my SECRET PROPERTY BLUEPRINT!" BOOM! cue stampede of wannabe property moguls.

The highlight? Watching what I can only imagine as sensible adults sprinting down aisles, credit cards at the ready, to drop $10,000 on joining what I can only describe as a property cult... I mean, club... sorry………"exclusive coaching program."

But amid the chaos and hard-sell tactics, one piece of "wisdom" was hammered home repeatedly: "Buy as close to the CBD as possible!"

It seemed logical then. It seems logical now.

But is it true?

Well, after years of research and actual data analysis (you know, the boring stuff they didn't mention at the seminar), I've got some interesting news for you...

For The Newbies

A very warm welcome to all the new subscribers! We’re thrilled and honoured to have you as readers and truly appreciate your thoughts and feedback 🙏.

Each edition of this newsletter will contain a deep dive into the property experts, investors, and all-around legends that grace us with their time and energy for the Facebook lives we run in our Facebook Group Aus Property Investors.

Now Australia’s Largest Property Investment group with over 78,000+ members!

For those who need a catch-up when they aren’t free for an hour [or sometimes 2] at 7:30 pm Wednesday night (we know we’re not), we created this newsletter, along with recording the sessions on our Youtube channel.

If this has any value for you at all, feel free to share and forward this newsletter to a friend!

That helps us a lot in bringing the best property guests Australia has to offer!

November 2024 Live Guests!

Vince & Jeremy Iannuzzelli

Jeremy Iannuzzelli, An Expert Account has over 15 years of experience dealing with small to medium business enterprises along with his bread and butter property investors. In addition Jeremy has managed to build a 20+ Property Portfolio worth $17 million and combines a unique skillset of an intimate tax knowledge with an ability to execute on his own profitable Property Deals!

His core focus is helping property investors create effective tax structures in line with their goals and objectives while providing sage insights on how to grow their Portfolios.

With over 36 years of experience at PwC, including two decades as a Director in Private Clients, Vince continues to offer expert guidance to businesses and individuals.

His areas of expertise include accounting, taxation, superannuation, wealth creation, wealth protection, and a broad range of financial matters.

During this session, our discussion centred around If Removing Negative Gearing Would Crash Australian Property, with the juicy details unpacked along with heaps of practical key insights 💎!

Jeremy & Vince: "The removal of negative gearing stopped investment almost immediately; investment figures just changed overnight, and that proves how impactful such policy decisions can be."

This is a teaser of the gold 🏅 discussed in the Will Removing Negative Gearing Crash Australian Property?!💰 episode with more found by clicking the link below 👇

Jef & Joe

Joe Tucker is one-half of AUS Property Investors and the Founder & Head of Research at Property Principles Buyers Agency. He is a preeminent buyers agent that specializes in residential and commercial property investing. Jef Miles is one-half of AUS Property Investors. As a person with 10+ years of experience in Financial Services incl Mortgage Broking & Building His Own Multi Million Dollar Portfolio. He is a talented renovator and Property Developer, constantly breathing new life into tired and rundown properties, turning them into prized investments.

In this session, we focused on The Key Insights, Principles & Knowledge Any Investor Can Use To Create Their Own $150K Passive Income Portfolio breaking down how it can be done!

Joe: "Building the accumulation and foundation phase is critical. Once we’ve done that, we’ll move to the consolidation phase where we destroy the debt through strategies like subdivisions and granny flats."

This is a glimpse of our discussion on The Aus Property Portfolio - Key Principles To Build Your $150K Passive Income! episode. Dive into the many gems 💎 by clicking the link below 👇

Aaron Whybrow

Aaron is the “Bagpiping Mortgage Broker” playing great tunes heading up the Strategic Mortgage Brokers Team. Aaron understands the importance of providing the right guidance at the right time and prides himself in giving honest, tailored advise resulting in your objectives being met.

Having enjoyed 3 successful careers in his life, the learnings and skills from these have all come together giving you a mortgage broker with different yet highly essential skills.

This session’s conversation revolved around The Key Finance Insights Investors Need to Focus on To Build Their Portfolio!💎!

Aaron: “When you’re planning a property portfolio, you need to consider not just the next purchase, but the steps after that—how will your structure support the long-term growth of your investments?”

There are incredibly valuable insights in the How To Finance Your $150K Passive Income Portfolio episode. Explore the wealth of information by clicking the link below 👇

Kirsty Mattiazzo

Kirsty, the founder of The Leasing Lane, has close to two decades of experience in real estate, starting as a Property Manager in Darwin and advancing to leadership roles. A property investor herself, she established The Leasing Lane to specialize exclusively in Property Management, offering transparent, client-focused services.

In this session, we dived deep into The On The Ground “Truth” About What Is Happening In One of The Most Interesting Markets In Australia [Darwin]!

Kristy: "Median house rents have increased in the last quarter by close to 2%, to $646 a week, which when you can pick up a property for somewhere between that sort of 400 to 600 thousand dollar purchase price"

If the above 👆 summary of our conversation has sparked your interest, discover all of the amazing golden nuggets in The Truth About Darwin! episode by clicking the link below 👇

CBD Property Returns: When Facts Meet Fiction

Ever heard the classic property advice "Location, location, location" followed closely by "Buy as close to the CBD as possible"? It's time we put this age-old wisdom under the microscope.

Is proximity to the CBD really the golden ticket to superior capital growth, or are we all just following a herd mentality?

The Traditional Argument

We've all heard it before, properties closer to the CBD supposedly outperform those in outer rings because of……well, do they give a reason?

It just kinda sounds logical, right? And we accept it.

When we actually dive into the data, the results aren't exactly what the property spruikers would have you believe. Surprise. Surprise.

I’ll explain:

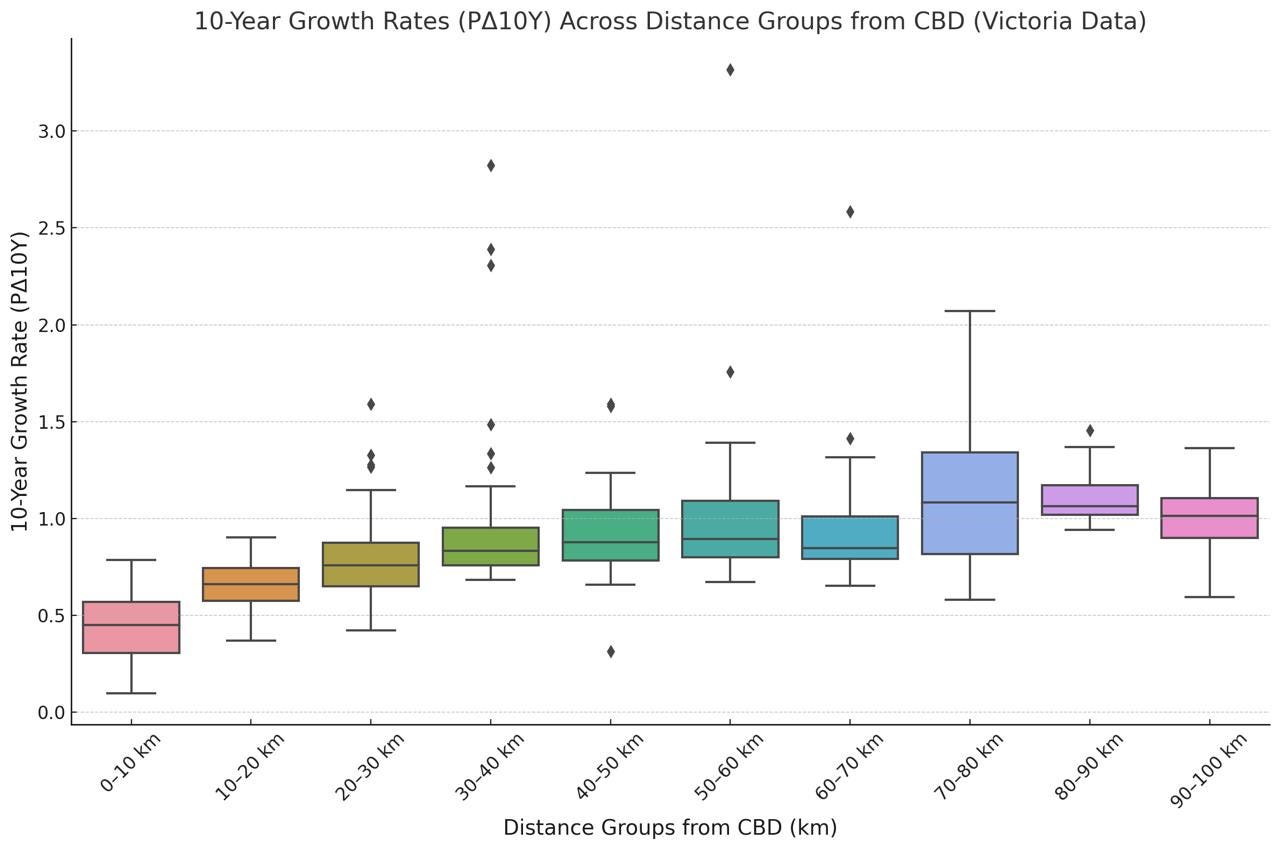

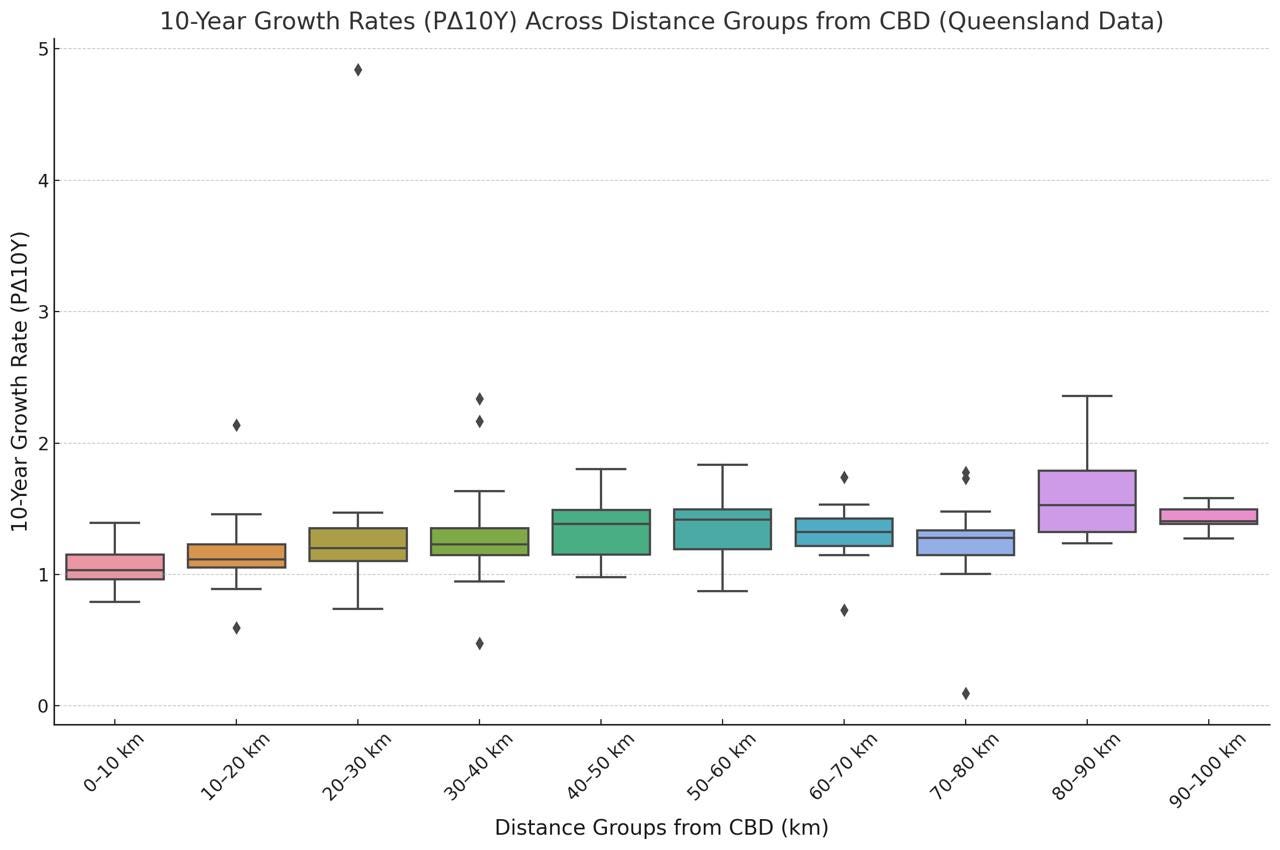

This chart below is called a Box chart. It’s broken down into 10km buckets on the X axis (bottom line), this is 10km from the CBD of that city up to 100km. The further to the right, the further out the kms go.

The Y axis, (left one that goes up), thats got the growth, so ignore the numbers on the left, it’s just comparing overall growth.

The boxes show the middle 50% of growth data, from the 25th percentile at the bottom to the 75th percentile at the top, with the median (50th percentile) marked by a line inside. Whiskers extend to the smallest and largest values within 1.5 times the interquartile range.

Nerdy stuff out the way.

All this to say it will show where the most growth has happened within the past 10 years, along the distance to the CBD on average.

The price range used is $500k-$2M, so properties that are $500K now, not $500K 10 years ago). This data covers most!

This will make more sense when you look at the charts.

Straight away, myth busted! 1 chart dispels the myth for NSW!

I actually didn’t believe the chart, as it’s saying that the best growth has actually been 90-100km. I ran it all again and the results are the same!

It’s literally the opposite of the common (now myth), “you should buy closer to the CBD!”

No you bloody shouldn’t.

South Australia, different results but same theme, closer ain’t better!

Surely Victoria has something different to say?

Nope!

QLD, the sunny state it’s all about CBD growth right?? Although all very similar growth, its not outstanding “CBD is best”

When we look at the data across our major capitals, the story gets interesting. And by interesting, I mean it completely challenges what those property "gurus" have been preaching.

In New South Wales, properties further from the CBD actually show stronger median growth rates, with areas 90-100km from the CBD outperforming inner-city locations.

South Australia paints a different picture, with middle-ring suburbs (20-40km) showing surprisingly robust performance.

Victoria throws another curveball, while inner CBD properties lag, the sweet spot appears to be in the 70-80km range.

And Queensland? It follows a similar pattern, with stronger performance trending away from the CBD.

Here's what's fascinating: not a single capital city shows the clear "closer is better" pattern that's been drummed into us.

In fact, if anything, these charts suggest the complete opposite. With many outer and middle-ring suburbs outperforming their inner-city counterparts over the 10-year period.

But before you start rushing to buy property in the outer suburbs, there's more to this story than just distance from the CBD.

Much more...

The Plot Twist: It Turns Out We've Been Sold A Story

Looking at these charts, one thing becomes crystal clear. The "CBD is best" mantra doesn't hold up under scrutiny. Each capital city tells its own unique story, but none of them support the traditional wisdom that closer means better returns.

And that’s where it gets really interesting: we're not just talking about a simple reversal where "further is better."

When we analyse properties between $500,000 and $2M within a 100km radius of each CBD, the picture becomes far more nuanced.

The Hidden Factors Nobody Talks About

The Subdivision Effect: Remember that outer suburban block that got carved into three? Traditional growth calculations often miss this completely, making outer suburbs look like under performers when they might actually be killing it.

Timing Is Everything: Property growth ripples outward like a stone thrown in a pond. Measuring at the wrong time? You might catch the inner suburbs at their peak while the outer suburbs haven't started their growth spurt. This is why we used 10 years, it levels things out. Using 30 years, many areas would be fields!

The Yield Factor: Here's a fun fact: those "inferior" outer suburbs often deliver rental yields that would make inner-city properties blush. Sometimes by more than 2-3%!

Ok, so a 2-3% difference in yield might not sound like much. But let's break down what this really means:

Imagine two $800,000 properties:

Inner-city property yielding 2% = $16,000 annual rental income

Outer suburb property yielding 4% = $32,000 annual rental income

That's an extra $16,000 per year in rental income! Over a 10-year period, we're talking about $160,000 more in your pocket (before costs). And that's not even considering the potential for rental increases or subdivisions.

Or the bloody fact it will have more growth!

What would you rather, $800K invested in a lower growth area or $800K in a higher growth area with a better yield? Thats what you’re getting!

Better growth and yield, that’s what investors crave!

Risk vs. Reward: The Real Story

Think dropping $2M on that inner-city terrace is your ticket to wealth?

Here's what they don't tell you:

Inner-city properties are often more volatile (yeah, they can go down too!)

You're putting all your eggs in one very expensive basket.

Less flexibility when it comes to selling (try selling half a house!)

You’re yield sucks, which affects your borrowing ability!

The Smart Investor's Playbook

So, what's the takeaway? Here's how to play it smart:

Match Your Strategy to Your Life Stage

Young investor? Maybe those higher-yielding outer suburbs deserve a look.

Near retirement? Think twice about those low-yielding inner-city properties.

Think Opportunity, Not Just Location

Inner suburbs: Already got everything

Outer suburbs: Potential for infrastructure improvements, rezoning, and value uplift.

Consider Your Budget Sweet Spot: Buy where everyday Aussies are pushing up prices!

Growth drivers beyond just CBD proximity

Areas with improvement potential

Markets with a balance of growth and yield

Is buying near the CBD a guaranteed path to superior capital growth? The evidence suggests not. While location matters, it's just one piece of a much bigger puzzle. Smart investors look beyond the CBD proximity myth and consider the following:

Their personal circumstances

Risk tolerance

The complete financial picture

Growth opportunities, regardless of location

Remember, sometimes the best investments are found where others aren't looking.

Perhaps it's time to widen our property search radius?

FREE Property Tool Of The Month!

The ABS [Aus Bureau of Statistics] is a treasure trove of information and data for property investors. We love “nerding out” on detailed insights for the macro data and information, including business indicators, financing, price indexes and inflation, which is super useful for investors with FREE and reliable data to understand the broader items impacting property market.

It’s got a fairly easy-to-use interface and here looking at Financing Indicators, with trends showing where finance is flowing and can indicate where investors/owner-occupiers are financing their latest deals!

That’s another Newsletter Wrapped up! Thanks for reading this Aus Property Investors Edition. Let us know your thoughts, share with friends & family to get the word out to the Property Crew! 🔥