Property Investments, Bogan Style: Ditch Fancy For Real Profits

Why investment-grade postcodes may be overrated for serious property investors.

We're AUS Property Investors, your Godfather of Property Investing - Making you an offer your portfolio can't refuse

This Month’s Run Down:

🗼 High-Stakes Property Jenga

💰 How To Profit From The Data You’re Not Looking At!

👨💼 Investor's Story! How To Scale a Profitable Portfolio!

💥 How To Profit From Becoming An Area Expert!

💡 Finding & Funding Profitable No Money Down Development Deals

🍺 Property Investments, Bogan Style

🧰 FREE Property Tool Of The Month

High-Stakes Property Jenga?

Happy Father's Day to all the dads balancing property deals like a high-stakes game of property Jenga—strategically stacking investments while keeping everything from tumbling down!

Investors face a tricky balancing act with interest rates peaking, predicted by us, and now the big banks . Property prices are likely to surge when rates drop, (hello more cash and higher borrowing ability) making it harder to buy in, but potentially boosting the value of what you already own. Yet, many investors are already feeling the squeeze, struggling with holding costs and questioning whether property is still the right game to play.

You just have to follow some of the conversations in our Facebook group.

It's a stressful situation, no doubt. One investor shared how they're battling hefty holding costs across multiple properties high value properties, even contemplating selling a few to ease the burden. But with the market conditions less than ideal, they're holding off, refinancing to keep things afloat. It's a dilemma that many can relate to—should you stick with property investing or explore other avenues, like ETFs?

Not financial advice, of course!

In moments like these, it's easy to feel overwhelmed. But it's worth reconsidering your strategy before you make any drastic moves.

Maybe the answer isn't in the suburbs where everyone's sipping lattes? Instead, it might be in those down-to-earth areas where bogans crack open a cold one, fire up the BBQ, and leave their mark with a few burnouts?

We see it all the time when investors buy where they live or buy based on higher values, which stretches them to near breaking!

Is there another way? Let's dive deeper and see how a shift in perspective could bring you closer to real property success.

For The Newbies

A very warm welcome to all the new subscribers! We’re thrilled and honoured to have you as readers and truly appreciate your thoughts and feedback 🙏.

Each edition of this newsletter will contain a deep dive into the property experts, investors, and all-around legends that grace us with their time and energy for the Facebook lives we run in our Facebook Group Aus Property Investors.

Now Australia’s Largest Property Investment group with over 75,000+ members!

For those who need a catch-up when they aren’t free for an hour [or sometimes 2] at 7:30 pm Wednesday night (we know we’re not), we created this newsletter, along with recording the sessions on our Youtube channel.

If this has any value for you at all, feel free to share and forward this newsletter to a friend!

That helps us a lot in bringing the best property guests Australia has to offer!

August Live Guests!

Luke Metcalfe

Luke Metcalfe, the founder of Microburbs, is a veteran data scientist who has been innovating in the real estate space since 2014.

Luke is integrating extensive property expertise with Microburbs’ vast data and machine learning capabilities to bring deeper understanding to the real estate market, looking to give you the key insights on how to analyse your next investment grade suburb.

During this session, our discussion centered around The Inside Scoop On How & What Data You Need To Assess To Outperform 💎.

Luke: "The biggest factor to always consider is market cycle timing. Markets get mispriced – you have exuberant markets and overly pessimistic ones, and understanding where a market sits in its cycle is key to making informed investment

decisions."

This is a teaser of the gold 🏅 that we discussed in the How To Profit From The Data You’re Not Looking At!💰 episode that can be found by clicking the link below 👇

Kellie Gee-Adams

Kellie is a dedicated Australian Nurse who began her property investment journey with limited prior knowledge & has absolutely shot the lights out. Despite re-starting her property journey after a few set-backs, she has successfully acquired six properties within just two and a half year.

Now in her mid-40s, Kellie's story is a testament to determination and the ability to achieve significant goals with perseverance.

In this session, we focused on The Process of How to Build a Scalable Portfolio Quickly!

Kellie: “When people go, 'Where do I buy a house?' they're jumping straight to that

implement part, and I would suggest what's worked for us is going, 'Okay, what

do we need to do? What do we need? What do we want to get out of this?

Where are we at?' You know, looking at what you've got serviceability-wise

versus equity, and what your actual goal is in the end.”

This is a glimpse of our discussion, and there are tonnes of valuable insights into How To Scale a Profitable Portfolio! Investor's Story! episode. Dive into the gems 💎 by clicking the link below 👇

Scott McWilliams

Scott McWilliams is a passionate property investor and renovator. Scott is well-versed in the rewards and challenges of property investment. As such, he is impeccably qualified to impart his knowledge to other investors and helping them on their property journey as an area expert.

Scott McWilliams opened Ideal Property Co after working as a Business Development Manager & Sales Agent in Brisbane and Townsville for the last five years.

This session’s conversation revolved around How To Become An Area Expert - What Scott Looks At - The Metrics!

Scott: “To become an area expert, you need to see what’s happening in an area, for example when renos are happening in an area and we see places like these old

social housing properties that got sold to private investors, we know change is

going to happen. You only know this when you understand what is going on in an area.”

There are incredibly valuable insights in the "How To Profit From Becoming An Area Expert!" episode. Explore the wealth of information by clicking the link below 👇

Adrian Cicino

Adrian Cicino is a real estate professional who went on a journey from a Chartered Civil Engineer where he has managed large Infrastructure projects worth a total of $2 billion to now helping powering the Palise Property team while also finding amazingly profitable development deals!

With an impressive portfolio himself, he is a believer in the power of investment and driving passive income. He has turned his hand to buying and nailing development deals with a focus on partnering and achieving little to no money down deals.

Adrian enjoys sourcing properties and working closely with clients - understanding their life goals and helping them achieve these through property investment.

In this session, we dived deep into The Nuts and Bolts Process of How to Find, Fund & Execute No Money Down Development Deals!

Adrian: “Everything's a negotiation. You can go out there looking for as much profit as you want, but at the end of the day, the investor might be thinking, 'Well, I can make X amount of return if I go down this investment route, so what you're presenting to me needs to be better than that option.”

If the above 👆 summary of our conversation has sparked your interest, discover all of the amazing golden nuggets in The “How To Create No Money Down Development Deals!” episode by clicking the link below 👇

Property Investments, Bogan Style: Ditch Fancy For Real Profits

When it comes to property investing, everyone loves to talk about “investment-grade” areas. You know, the posh postcodes with leafy streets, trendy cafes, and Teslas in the driveways.

It sounds great on paper, but here’s the kicker—are these fancy suburbs really worth the hype? Or are we just getting dazzled by the glitter and missing out on the gold?

Let’s take a deep dive into why you might want to consider ditching those pricey postcodes in favour of a more down-to-earth approach.

Welcome to property investing, Bogan style!🍻

Should you be putting all your eggs in only 1 property/basket? If you spend $1M you wont be able to buy many more of these properties and the cashflow will be terrible!

What Really Drives Property Growth?

Here’s where it gets interesting. Property growth is all about supply and demand.

Simple, right?

Prices go up when more people want to live in an area than homes available…….kinda, but not that simple! Becauses here’s the catch—when an area becomes too expensive, demand starts to dry up, affordability becomes a factor because there needs to be money to push the prices.

Property doubles every 7-10 years?

Try doubling $6M for 50 years…..

People get priced out, and suddenly, those skyrocketing prices hit a ceiling.

On the other hand, more modest suburbs often fly under the radar. These are the places where everyday people live—hardworking, no-nonsense folks who don’t care about the latest artisan latte. And guess what? These areas can offer serious growth potential. Why? Because they’re affordable, they’re in demand, and there’s room for prices to increase.

Not just that, the yield on your capital is far better!

A $2M property that has a 2.5% yield has a far higher negative cashflow than…..

Owning 4 properties at $500,000 at a 5.2% yield, along with diversity of asset. You could own in WA, VIC, QLD and NSW!

The Risk of Overpaying

When investing in a high-end area, you often pay a premium just for the postcode. Sure, you might see some growth, but there’s also the risk of overpaying. You’re buying at the top end of the market, and if things go south—like a dip in the economy—those expensive properties can lose value faster than you can say “clearance sale.”

This is also backed up in the data, when the market is good, these areas go on a tear…..but when it’s bad, oh boy. Hold on!

Investing in more affordable suburbs means entering the market at a lower price point. There’s less risk of overpaying, and your property has room to grow. Plus, during economic downturns, these areas often hold their value better because they’re more accessible to a broader range of buyers.

The Myth of Prestige

Let’s bust another myth while we’re at it.

The idea that only posh areas can deliver strong returns is outdated. Sure, living in a fancy suburb might be great for your social status, but the numbers tell a different story when it comes to investment returns. The unassuming, no-frills suburbs often outperform because they have what really matters—a large market of people with the capacity to increase prices!

These areas are where the real potential lies. They might not have the glitz and glamour, but they have something even more valuable—affordability, stability, and room for growth.

And isn’t that what property investment is all about?

Look at this chart by Core Logic’s August Property Market Update 12 month numbers:

The affordable and regional markets have killed Sydney, Melbourne and Canberra (higher value areas), while Perth has grown 24.7%, Adelaide 15.5% and Brisbane 16% (arguably, now becoming unaffordable in many pockets).

To put that in real terms a property worth $500,000, if bought in WA would be worth $622,500…….

If bought in Sydney, some boxey disgusting unit 🤮 for $500,000…..or let’s say it’s a lovely glitzy unit, the numbers don’t care. Your property after the 5.6% growth is worth $528,000 (then minus gross strata fees and now I bet you do feel sick!)

That’s $94,500 difference.

A Balanced Approach

Of course, I’m not saying you should never invest in a high-end suburb. There’s value in diversity, and having a mix of properties in different areas can spread your risk.

But it’s essential to approach these investments with your eyes wide open. Don’t get caught up in the allure of a fancy postcode at the expense of solid returns.

Consider balancing your portfolio with properties in more affordable suburbs. Look for areas with strong rental demand, good infrastructure, and growth potential. These might not be the flashiest suburbs, but they could be the most profitable in the long run.

Practical Steps for Investors

So, how do you get started with a Bogan-style investment strategy? Here are a few tips:

1. Research Up-and-Coming Suburbs: Look for areas on the cusp of growth. These are usually suburbs with good infrastructure, schools, and amenities but where property prices haven’t yet peaked.

2. Focus on Rental Demand: Invest in areas with strong rental demand. This ensures a steady income stream, even if property prices don’t skyrocket overnight.

3. Diversify Your Portfolio: Don’t put all your eggs in one basket. Mix it up with a combination of properties in different areas and price points to spread your risk.

4. Stay Grounded: Keep an eye on the fundamentals—supply and demand. Fancy suburbs might be tempting, but the solid, everyday areas often deliver the best long-term returns.

5. Data: There is a time and place for every type of investing, so you need to really ensure there are strong data indicators moving the market. Look for trending down days on market, not lots of new supply coming to market, solid vacancy rates, not wild previous growth.

Invest Smart, Not Fancy

At the end of the day, property investment isn’t about showing off or impressing your mates (to be fair, they really don’t care, which is why you have us, you’re property people).

It’s about making smart decisions that will pay off in the long run. So, before you jump into that “investment-grade” suburb, take a moment to consider whether it’s really the best choice for your money.

Sometimes, the path to property riches isn’t paved with gold. It’s paved with common sense, a keen eye for opportunity, and a little bit of Bogan-style wisdom. Invest smart, stay grounded, and watch your profits grow—no fancy postcode required!

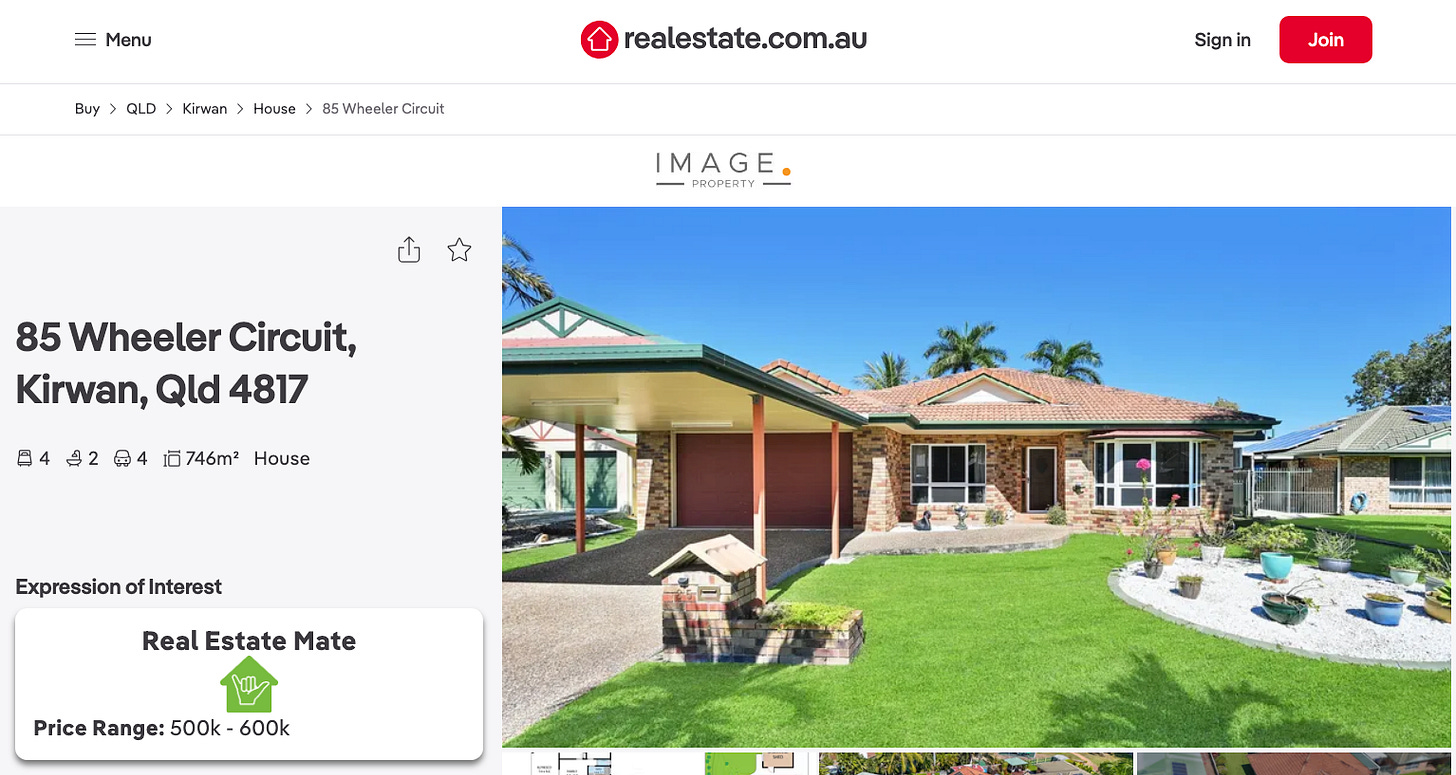

FREE Property Tool Of The Month!

This month’s tool is a must-have! It’s a free Chrome extension for realestate.com.au that uncovers those hidden prices behind “Contact Agent” listings.

No more guessing games or awkward calls – just the info you need, right when you need it!

Now, to be honest, we know out audience………if you’re sitting there thinking, “What’s a Chrome extension?” – don’t worry, it’s just a fancy way of saying it’s a little tool you add to your Chrome browser. And yes, it does have to be Chrome, so if you’re still using Internet Explorer, it’s time for an upgrade!

But believe me, it’s worth the switch. This extension gives you a sneak peek into what agents think properties are worth, which is pure gold for investors.

No ties to the creators here, but we’re big fans of anything that gives us an edge. Check it out – it could be the secret weapon you need to find your next great deal.

That’s another Newsletter Wrapped up! Thanks for reading this Aus Property Investors Edition. Let us know your thoughts, share with friends & family to get the word out to the Property Crew! 🔥