The Boomers Are Buying Property Again (Just Not What You Think)

Why downsizers and young professionals are shaping the next decade of growth.

We’re AUS Property Investors, the crew that reads census data like others read horoscopes. “Scorpio rising with a Baby Boomer making bank.” 🧘

This Month’s Run Down:

📈 Demand Before Location: Why “Who” Matters More Than “Where” in 2025

🧠 The Demographic Shift Investors Can’t Afford to Ignore

🏡 Forget the Average Family

🔍 Matusik’s Data Reveals the Real Growth Corridors (Not in the News Yet)

📊 Victoria to Soak Up 35% of Housing Demand

🔥 The Barbell Market: Why Middle Australia Is Out, and Edges Are In

🏘️ Regional Victoria Set to Outpace Adelaide.Yes, You Read That Right

🧰 FREE Tool of the Month

Where The People Flow, Allow Your Portfolio To Grow!

I am going to tell you exactly where is going to grow in value and the type of property property you should be thinking about, so you can consider yourself one of the top 1% of investors.

And make money like those folks!

But before we do that, there’s this old-school belief in the property world that sounds something like: “Location, location, location.” And sure, we’re not going to argue directly, but I think we can remove the first 2 “Locations”

Here’s the upgraded 2025 take:

“Demographics, Demand, then Location.”

You see, where people want to live only matters because of who those people are (and how many of those people there are), what they want, and how much they can afford.

We’re talking about a shift so obvious, it’s almost invisible. It’s not in the news headlines.

It’s not “hotspot” hype. But it’s pretty damn valuable.

And if you understand it, like really get it, you could position yourself ahead of 99% of investors who are too busy chasing shiny objects.

Most people are looking at where. Smart investors are starting to ask who.

Who’s actually driving the next phase of demand? Who’s being ignored by developers? And most importantly who’s going to pay more for the right kind of property in the right area?

That’s what we’re going to unpack today, along with some pretty interesting data from Matusik!

For The Newbies

A very warm welcome to all the new subscribers! We’re thrilled and honoured to have you as readers and truly appreciate your thoughts and feedback 🙏.

Each edition of this newsletter will contain a deep dive into the property experts, investors, and all-around legends that grace us with their time and energy for the Facebook lives we run in our Facebook Group Aus Property Investors.

Now Australia’s Largest Property Investment group with over 82,000+ members!

For those who need a catch-up when they aren’t free for an hour [or sometimes 2] at 7:30 pm Wednesday night (we know we’re not), we created this newsletter, along with recording the sessions on our Youtube channel.

May 2025 Live Guests!

Sam O’Connor

Sam O'Connor is an ambitious property investor who has successfully built a portfolio that allowed him to travel to over 25 countries. Through strategic acquisitions, he amassed six properties which formed the foundation of his financial freedom.

Sam’s journey reflects persistence and a clear vision, turning property investment into a lifestyle of mobility and independence. Once a long-time viewer, he's now sharing his experience to inspire others on their investment path.

During this session, our discussion centred around insights on how to unlock the ability to build a Portfolio to a stage where this investor can travel, showing you how to get on your path to financial freedom, with the juicy details unpacked along with heaps of practical key insights 💎!

Sam: "Just because you're going with the second, third and fourth tier lender doesn't mean you're going to be there forever. Sit with them for a year or two years, deal with that extra 1%, and then when the property has increased... that's when you start making a shift into these better banks"

This is a teaser of the gold 🏅 discussed in the How This Investor Bought 6 Properties To Financial Freedom💰 episode with more found by clicking the link below 👇

Bushy Martin

Bushy Martin is a renowned Australian property investment strategist, author, and keynote speaker dedicated to helping people achieve financial freedom through smart property choices. With decades of experience, he has guided thousands towards building sustainable wealth.

Bushy is the founder of KnowHow Property and host of the Get Invested podcast... inspiring listeners with real-world insights. His mission is to empower others to live life on their terms through informed property decisions.

In this session, we focused on the Proven Investor Strategy That Helps Achieve Sustainable Success And Financial Freedom 🏡💎!

Bushy: “Infrastructure, industry and incomes, focusing on these in an area that’s got scarcity”

This is a glimpse of our discussion on How Property Strategy Can Unlock Financial Freedom episode. Dive into the many gems 💎 by clicking the link below 👇

Jeremy Iannuzzelli

Jeremy Iannuzzelli is a trusted accountant and Managing Partner at Praedium Partners, known for helping Australians grow and protect their wealth through strategic tax planning.

He is a specialist property accountant and property investor with a $20 Million+ Portfolio and a proven track record of helping 1000’s of investors. Jeremy delivers tailored advice that empowers clients to achieve success, well beyond just money. He’s passionate about guiding people to make smarter decisions that shape a stronger financial future.

This session’s conversation revolved around How To Build A Portfolio While Also Not Being Afraid To Sell Strategically 😮💎🍎!

Jeremy: “If you are selling you're not selling to buy you know golden handcuffs and Ferraris and chandeliers you're selling to put that money into another market where you're primed and ready to get that next leg of growth and the beauty of it is that the data around property has never been so well constructed like it is today”

There are incredibly valuable insights in the Why & Where Investors Are Selling Their Properties episode. Explore the wealth of information by clicking the link below 👇

Jef & Joe

Joe Tucker is one-half of AUS Property Investors and the Founder & Head of Research at Property Principles Buyers Agency. He is a preeminent buyers agent that specialises in residential and commercial property investing.

Jef Miles is one-half of AUS Property Investors and now Strategic Investment Savvy Broker & Managing Director at Step Up Loans. As a person with 15+ years of experience in Financial Services incl Mortgage Broking & Building His Own Multi Million Dollar Portfolio. He is a talented Renovator and Property Developer, constantly breathing new life into tired and rundown properties, turning them into prized investments.

The gents are now helping you do it for yourself with their guidance and mentoring, step by step, deal by deal with Level Up Property!

This session’s conversation revolved around Revealing How You Can Build Your Own, With The Key Steps To Renovating To Build Your $150k Passive Income Portfolio! 💎

Jef: “You have to make sure the finance is buttoned up, particularly if you’re doing a renovation deal as you need to understand how much capital is going to go into the renovation”.

Joe: “Doing these renovations is to get equity so that you can continue buying property… It speeds things up”Doing these renovations is to get equity so that you can continue buying property... it speeds things up."

There are incredibly valuable insights in the How To Build Your $150K Passive Income Portfolio Through Renovating episode. Explore the wealth of information by clicking the link below 👇

Go Where The Demand Is….. 🎣

You wouldn’t fish in a puddle would you?

Why not? If you read last months article about Supply & Demand, you would realise that Demand is pretty bloody important.

And puddles ain’t got no fish!

So lets’s talk about where the demand’s actually going and it’s not where you think.

Everyone’s talking about migration, and interest rates but hardly anyone’s zooming out and asking the bigger question:

“Where are we actually going to need homes?”

Matusik’s numbers give us a pretty loud answer, and if you’re an investor, it’s like having the cheat codes for the next decade.

Let’s start with the something that’s pretty bloody crazy

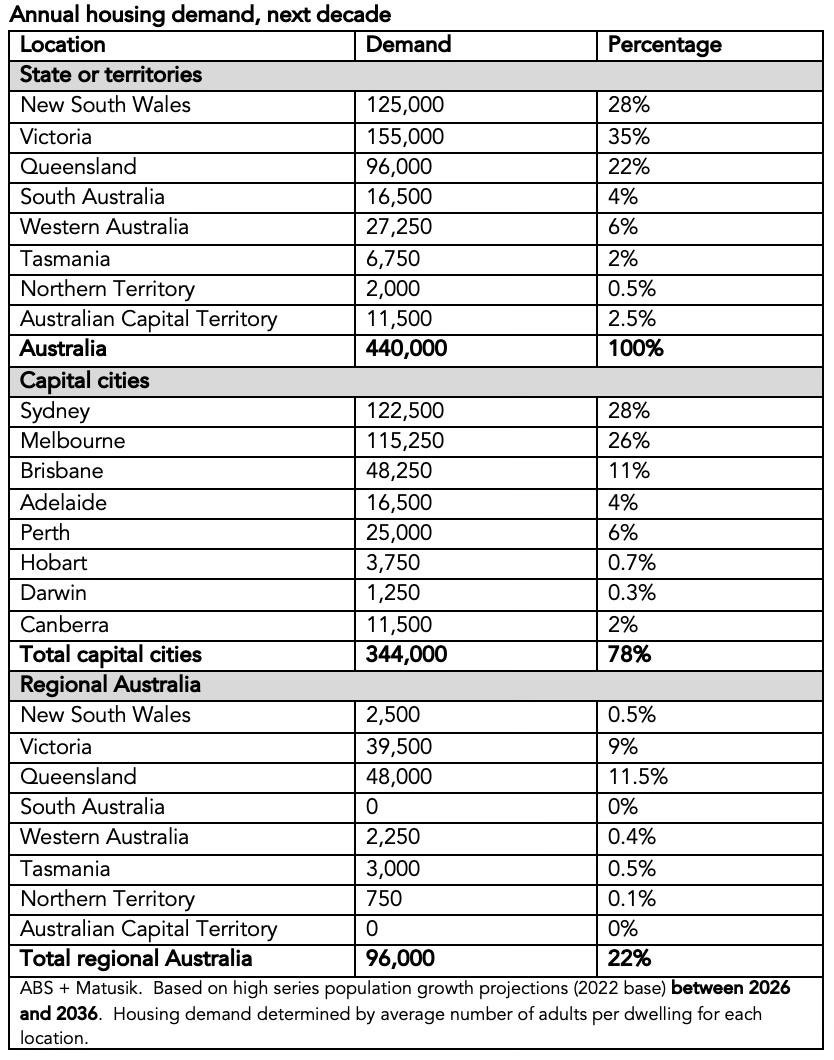

”Australia needs 440,000 homes every single year for the next 10 years.”

Close to a new Canberra each year…..Wow!

And that not “wants”, it’s Needs!

And it’s not evenly spread.

Victoria alone accounts for 35% of that demand, more than any other state. Yep, more than New South Wales. More than Queensland. More than anywhere.

So if you’re sitting on the sidelines watching Melbourne like it’s “still in recovery mode”

Good. Stay there.

Because those of us who understand the forward demand are already loading up.

Remember when Jef & I said “Buy Right Now” in Perth 3 years ago? You would have made over $300K on just 1 property!

This is that moment, again (but please don’t tell everyone, we don’t want the competition 😉)!

And when I say this, I don’t mean it like a “Greedy property investor” I mean, “Supply these folks with much needed homes!”

But there’s more to it...

Sydney, Melbourne and Brisbane make up 65% of Australia’s total housing demand, and yet planning policies, cost blowouts and builder bottlenecks mean we’re not even close to hitting the needed supply levels.

That gap between what’s needed and what’s being built?

That’s your window. That’s your profit and your potential.

While we’re talking numbers, don’t sleep on regional Victoria either. It’s set to absorb nearly 40,000 new homes per year, more than the entirety of Adelaide’s total capital city demand.

So while the headlines say the market’s slow or the growth is elsewhere, what they’re really saying is: The crowd hasn’t caught on yet.

And that’s exactly when smart investors make their move.

Looking For Growth? Stop Thinking About “The Average Family”

Ok Joe, you got my attention, lots of folks are making a shift, but how should I think about it? Who is buying?

Stop thinking about “The Average Family”.

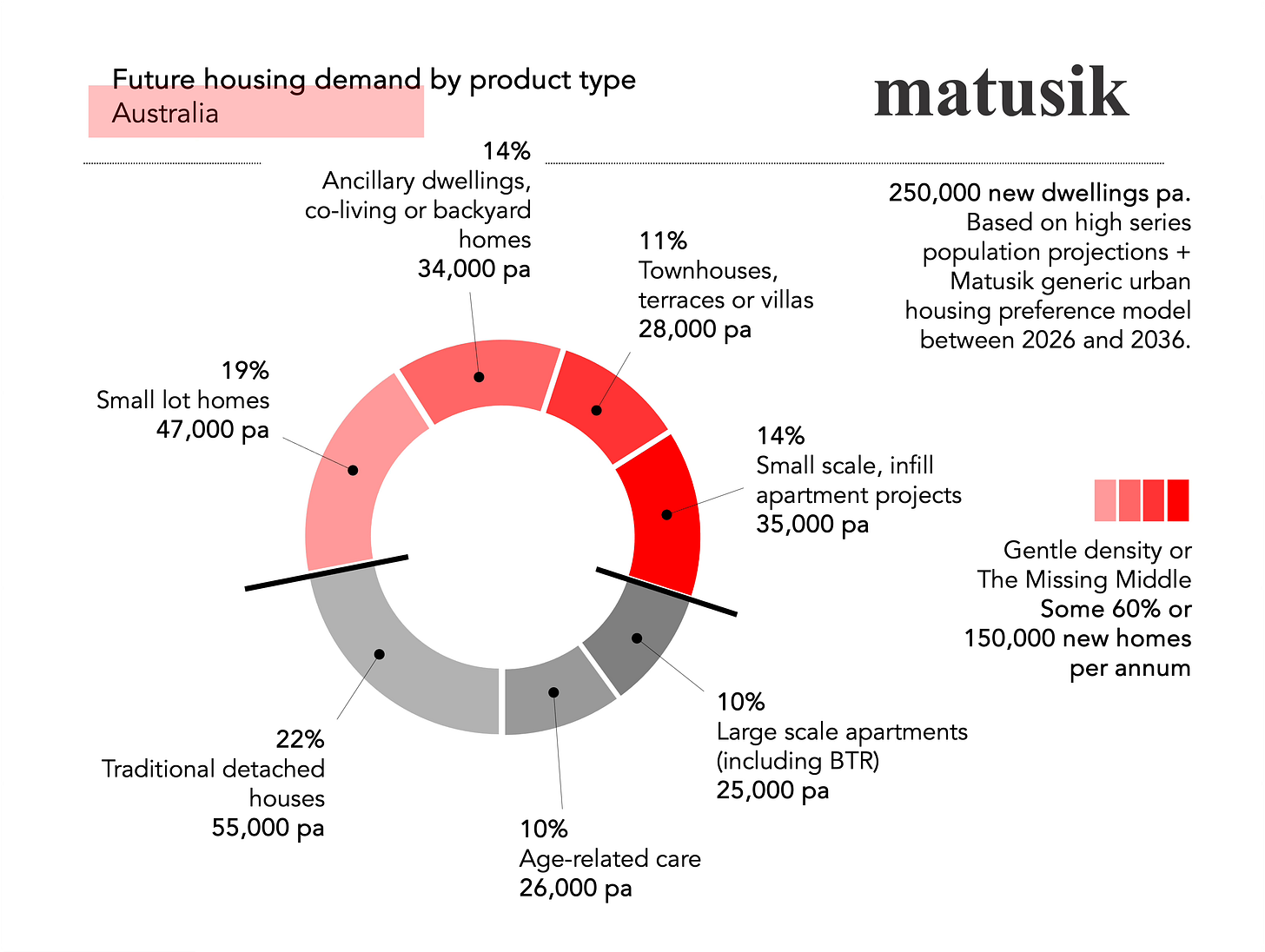

The two biggest demographic groups driving housing demand over the next decade?

Young singles and couples and the older generation looking to downsize.

That’s it. That’s your buyer and renter profile. Everyone else? Kinda flat.

There was a saying back in the day that said “Sell to the Boomers at every life stage” and it’s still holding true!

We’re not building for the middle anymore.

The demand is barbell-shaped, heavy at both ends, light in the middle. And that changes everything.

Here is the image from Matusik that illustrates the point visually:

Now here’s where it gets juicy.

With the rise of remote work and access to the cities, folks don’t need to settle for units in a high rise just to get to their job, nor do they want to live in that product anyway.

Instead, what’s growing is the need for:

Compact, well designed apartments that don’t feel like shoeboxes

Townhouses and villa-style dwellings with smart layouts

Dual living or co-living options that cater to multi-generational households

Low-maintenance homes for downsizers who want to stay in their community

So if you’re an investor, here’s your unfair advantage.

Start aligning your strategy with this shift. Go after properties that are tailored to these groups. That’s where rental demand will spike. That’s where price pressure builds. And that’s where capital growth tends to follow.

If you’re an investor thinking……”Hey, I can knock down my massive 4x2 on 1,000ms into 3 smaller dwellings that would appeal for these folks”

Now we’re talking!

Now you’re the one buying wholesale and selling retail.

Local councils and planning bodies are asleep at the wheel. They’re either blocking development, dragging their feet on zoning, or hitting developers with fees that make infill housing unviable. Meanwhile, demand is piling up.

This misalignment? It’s an opportunity for savvy investors.

If you can find the suburbs where downsizers want to stay, or where young renters are flooding in but supply isn’t keeping up, you’ve found the goldmine.

And don’t get distracted by the “first home buyer” noise either. That market’s small, and shrinking in real terms. The big gains are going to come from catering to upgraders and downsizers.

The ones with equity. The ones with urgency. The ones with spending power.

The market’s changing. But that’s good news!

Because while everyone else is still chasing what worked 10 years ago, you’ve got the playbook for what’s coming next!

Sponsored By The Level Up Property Course

Remember when Homer decided he was going to be an inventor?

He quit his job, bought a shed, chucked on a lab coat and somehow came up with a makeup shotgun, an electric hammer, and a chair with extra legs for tipping back.

And he was so sure he was onto something.

That’s exactly what the average property investor looks like when they dive into property investing. A lot of energy. A dream in their head. And absolutely no idea what they’re doing.

”What’s your forrrtss on Perth?”

The result are….

Painful. Chaotic. And expensive.

In the Property game, enthusiasm isn’t enough. You can’t wing it with a few YouTube videos and a podcast episode. That’s how people end up:

Spending months researching but getting nowhere

Skipping due diligence, because it sounds boring or complicated

Buying out of fear, just to say they’ve finally “done something”

Regretting it all, when the numbers don’t stack up and the growth stalls

Too many people are building portfolios that look great in theory, but in reality? It’s a shotgun blast of makeup to the face.

That’s why we built the Level Up Property Course. So you ace it every time!

Check Out The Level Up Property Course CLICK HERE 👈

After 15+ years in the game, Jef and I, you know the guys who have bought over $100M+ in property deals and still buying in today’s market, and leading Australia’s largest property community (that’s 82,000+ investors, by the way), we’ve packed everything we know into one powerful course.

The guys that have literally created millionaires through property investing!

It’s not hype. It’s not guesswork. It’s the system we wish we had starting out. This is what I am using every single day in my Buyers Agency business for clients. You get it all, and much cheaper than my service.

Here’s what you get:

Step-by-step frameworks for spotting high-growth markets (no more guessing)

The 3 Phases of Due Diligence, explained simple so you can crunch deals fast

Negotiation strategies to help you buy under market value

Free 6-month HTAG subscription (valued at $1,100+) for real data-driven decisions

Group Coaching Calls with us every 3 weeks

Private Facebook Mentoring Community, run by us directly

This isn’t theory. These are tools that have helped 1 investor unlock up to $768,000 in equity in under 3 years.

So, if you’re ready to stop guessing your way through one of the biggest financial decisions of your life, it’s time to Level Up.

The first 20 people get direct mentorship, so don’t sleep on it.

No more chaos. No more electric hammers.

Let’s build a portfolio that actually works.

*This newsletter is sponsored by our friends at Level Up Property Course.

FREE Property Tool Of The Month!

Profile.ID is a serious free resource for Property Investors. Given the importance of understanding the Data and demand that will drive growth in the area, we have a cracking tool to unpack statistics from employment, population growth [including forecasted growth of population] & much more.

We love “nerding out” on detailed insights for the state and area specific information, which is super useful for investors with FREE and reliable data to understand the broader items impacting property market.

It’s got a fairly easy-to-use interface and has a lot of insightful information to help you build that passive income Empire!

That’s another Newsletter Wrapped up! Thanks for reading this Aus Property Investors Edition. Let us know your thoughts, share with friends & family to get the word out to the Property Crew! 🔥