The Hidden Costs of High Rental Yields

Why Focusing on High Rental Yield Might Be A Bad Idea.....

We're AUS Property Investors, your financial Trump card - playing the winning hand in every market!

This Month’s Run Down:

🕵️♂️ How to Evaluate Properties Like Donald Trump

💰 Strategies for Ultimate Financial Control

💡 Lessons From The $26 Billion Man

🏚️ Why The Property Market Is Broken

🛞 What is Driving The Tasmanian Property Market

💸 The Hidden Costs of High Rental Yields

🧰 FREE Property Tool Of The Month

Trump's Election Drama and Property Fun

The Hidden Risks Behind High-Stakes Investments

We’re Aussies, and we’re not here to talk US politics, but as the US election circus unfolds, it's hard to escape Donald Trump's magnetic pull. You can’t turn on the telly or TikTok without seeing his fancy hairdo!

Love him or hate him, Trump's journey from a real estate mogul to the Oval Office has always been a spectacle, combining political drama with his knack for savvy investments.

His ability to capitalise on prime property deals is legendary, often cited as a benchmark of business acumen, he literally wrote the book called “The Art of the Deal”!

Let's pivot from the political theatrics and take a closer look at Trump's property investments. Known for his high-growth development deals and luxurious properties, Trump's portfolio includes some of the most iconic buildings in the world.

His investments are synonymous with high returns and opulence, from the glittering Trump Tower in New York to the massive Mar-a-Lago estate in Florida.

Mr Trump goes for Growth!

However, Trump's property empire isn't just about the glitz and glam. It's a world where high stakes come with high risks. We see he isn’t focused on high yielding properties in the middle of mining towns.

Cashflow is important, it’s the life blood of a portfolio but growth is what allows you to push beyond the next deal.

As the US navigates the chaos of the election season, it's worth reflecting on the lessons from Trump's growth strategy, while we all navigate the challenges of property investing.

Focusing only on high yielding properties while putting growth on the back burner can be a huge mistake beginner investors make.

In this month's newsletter, find out more about the hidden cost of high rental yields.

For The Newbies

A very warm welcome to all the new subscribers! We’re thrilled and honoured to have you as readers and truly appreciate your thoughts and feedback 🙏.

Each edition of this newsletter will contain a deep dive into the property experts, investors, and all-around legends that grace us with their time and energy for the Facebook lives we run in our Facebook Group Aus Property Investors.

Now Australia’s Largest Property Investment group with over 74,000+ members!

For those that need a catch-up when they aren’t free for an hour [or sometimes 2] at 7:30 pm Wednesday night (we know we’re not), we created this newsletter, along with recording the sessions on our Youtube channel.

If this has any value for you at all, feel free to share and forward this newsletter to a friend!

That helps us a lot in bringing the best property guests Australia has to offer!

May Live Guests!

Bernadette Christie-David

Bernadette is the Director of Atelier Wealth, which she and her husband Aaron co-founded several years ago. Bernadette’s experience, knowledge and qualifications span 7 years in financial services. She has a wealth of lending knowledge with a particular passion for helping property investors find a way to extend their borrowing capacity to build double digit property portfolios through the expert use of structures.

During this session, our discussion centred around The Key Parts Of Self Managed Super Funds [SMSFs] And Structures To Help You Go Beyond 3 Properties And Take Control Of Your Financial Future! There was a heap of value, passion and great tips and tactics for anyone to implement to their property portfolio.

Bernadette: "If you're considering an SMSF, think about it as setting up a small business. It's about the long game, investing in assets that will grow over decades, not just years. You need to be very clear about your investment goals when setting up an SMSF. It's not just about buying property; it's about building a portfolio that will fund your retirement."

This is a teaser of the gold 🏅 that we discussed in the Unlocking SMSF: Strategies For Ultimate Financial Control💰! episode that can be found by clicking the link below 👇

Tyron Hyde

Tyron has a Degree in Construction Economics (UTS) and is a Fellow of the Australian Institute of Quantity Surveyors. He began his career at Washington Brown in 1993 & he is now the sole owner of the place.

With his passion and knowledge of property depreciation, Tyron is a regular speaker at industry conferences and is often quoted in national media. He has also published numerous articles and books including his popular Keep Claiming It book.

In this session, we focused on The Key Lessons He Took from the $26 Billion Dollar Man, which are all relevant for the everyday investor along with many game-changing and money saving depreciation insights!

Tyron: “One of the biggest misconceptions is that if you buy at the bottom, you're set for life. But it's not just about buying; it's about managing the asset efficiently and making sure it aligns with your long-term investment strategy. Many overlook that part, focusing only on the acquisition.”

This is a glimpse of our discussion, and there are tonnes of valuable insights in the Lessons From The $26 Billion Man! episode. Dive into the gems 💎 by clicking the link below 👇

Martin North

Martin North is the Principal of Digital Finance Analytics (DFA), a boutique research, analysis and consulting firm providing advisory services to Companies in Australia and beyond.

He has advised more than 100 organisations in aspects of strategy, finance reporting and property analytics. North is well known for his dire predictions for the Australian Property Market in a 2018 segment of 60 Minutes called “Bricks and Slaughter”. He is much more than this though and is a well respected, if not occasional contrarian commentator on the Property Market & Economy.

This session’s conversation revolved around The Inside Scoop On What's Wrong With The Aus Property Market & How It Can Be Fixed!

Martin: “One of the arguments as to why prices may not drop is because governments won't allow them to drop. They'll throw more money into the system, the RBA will cut rates, the RBA will do property purchases to support the property sector.”

There are incredibly valuable insights in the "Why The Property Market Is Broken" episode. Explore the wealth of information by clicking the link below 👇

Melissa Burtt

Melissa is the Director of LJ Hooker Devonport, a Property Consultant actively selling along with assisting in Property Management along the North West Coast of Tasmania.

She has a deep and varied experience across industries with roles in Financial Services for close to 10 years including Financial Planning & A Branch Manager to then work in small businesses crafting her communication and sales ability.

In this session, we dived deep into A Marco Overview on What Investing In Tassie looks Like! Along the way we unpacked Aspects That Are Unique & Vital To Investing In Tassie.

Melissa: “One of the things that is really driving the market here is the affordability compared to the mainland. Even though prices have gone up, they are still relatively affordable. Infrastructure development is another key factor. We're seeing significant investments in infrastructure which will further support property values in the long term.”

If the above 👆 summary of our conversation has sparked your interest, discover all of the amazing golden nuggets in What is Driving The Tasmanian Property Market! episode by clicking the link below 👇

The Hidden Costs of High Rental Yields

Investing in property is a big deal. It's a path many of us take to build wealth and secure our futures. However, a common debate in the property investment world can be pretty confusing: Should you focus on high rental yields or capital growth?

Let's dive into this debate and clarify why capital growth typically generates more substantial long-term wealth than high rental yields.

The Allure of High Rental Yields

At first glance, high rental yields seem like a dream come true. Who wouldn't want a property that brings in a hefty rental income every month? Its immediate, tangible, and feels like a win. But here's the catch: while it might boost your cash flow in the short term, it often doesn't lead to significant long-term wealth.

Capital Growth: The Real Wealth Generator

Here's where capital growth comes into play. Unlike rental yield, capital growth refers to the increase in the value of your property over time. This appreciation can lead to significant wealth, far outstripping the income from high rental yields.

Let’s say you bought a property for $1,000,000

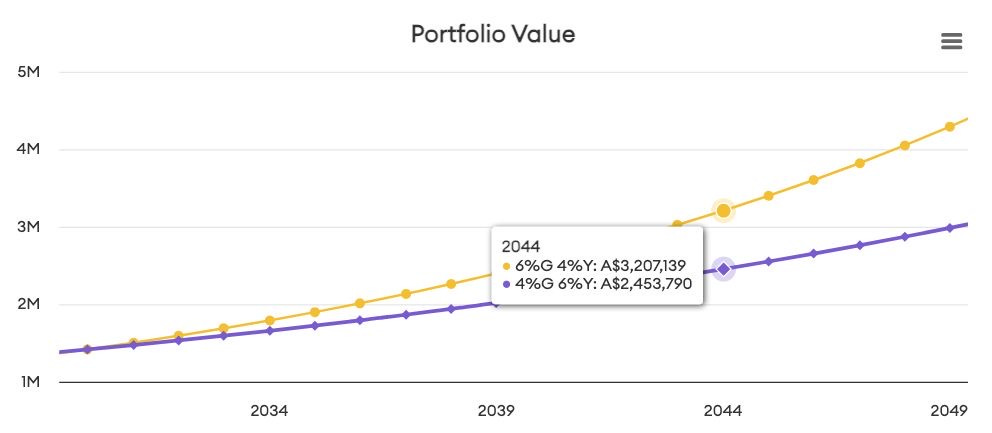

The difference between Property A's 6% growth and 4% yield and Property B's 4% growth and 6% yield over 30 years is significant.

After 10 years, property A generated $1,790,849, whereas property B only generated $1,657,693. Lower yield and higher growth outperformed higher yield and lower growth by about 8% in the first 10 years or $133,156!

After 20 years, the lower yield and higher value property A outperform the higher yield and lower growth property B by 30%. The difference after 20 years is already $753,349.

Property B: $3,207,139

Property A: $2,453,790

Bro (and sis)…..that is $753,349 of difference!

After 30 years, the difference is even more staggering.

Property B: $4,291,874

Property A: $2,985,412

That is a difference of $1,306,462

The lower yield, high growth property A outperformed the higher yield, lower growth property A by 43.76%.

What could you do with an extra $1M+?

Tax Implications

Higher-yielding properties may also come with higher tax burdens. The income you earn from these properties is taxable, and depending on your tax bracket, a significant portion of that rental income can go straight to the government. In contrast, capital gains tax, while still a consideration, is often more favourable when compared to the ongoing taxation of rental income.

Location, Location, Location

Properties with high rental yields are often in transient or less desirable locations. Think mining towns or areas with temporary housing demands. These places can suffer from higher vacancy rates, which means there might be times when your property sits empty, bringing in zero income. On the flip side, properties in high-growth areas usually enjoy lower vacancy rates and more stable long-term demand.

Balancing Act: Cash Flow vs. Growth

When it comes to investing, balance is key. Growth trumps cash flow, but you also need to buy a property that balances. This means you need to consider both cash flow and capital growth.

We've got two things to balance:

1. Cash and Equity

2. Borrowing Ability and Serviceability

If you purchase a high-growth property with a super low yield, you might strain your borrowing capacity. For example, if you go ahead and buy a million-dollar property at a 2% yield, you may ruin your serviceability because it's not bringing in enough cash flow. So, you must balance these things and ensure you can afford the properties you're buying.

The way we like to think about it is “Buy the highest growth asset that you can afford”. That means from a cash/equity standpoint, but also a borrowing ability and serviceability!

Yes, you can buy affordable, high growth assets with solid yields! High growth and high yield are not mutually exclusive, this is more a warning of aiming only to focus on yield, because that is a fool’s errand and may end in tears.

When High Yield Makes Sense

There are specific situations where high yield might make sense, such as during retirement or when you need to meet lending serviceability constraints. The immediate cash flow can help cover expenses or improve your borrowing capacity in these scenarios.

Practical Steps for Investors

When you're trying to buy a property, aim for the highest growth asset you can afford. Look for areas with strong capital growth prospects – good infrastructure, schools, and employment opportunities and in the right point of the market cycle where demand outstrips supply.

Try to get a property that can get you the best return. This doesn't mean high-yielding areas won't grow but don't focus solely on mining towns and other transient places that haven't demonstrated consistent capital growth.

Balancing your portfolio with properties that offer both decent cash flow and strong capital growth is the smart way to build enduring wealth.

Remember, it's about making informed decisions and not getting swept away by the allure of quick cash. So, next time you're eyeing that high-yield property, take a moment to consider the long-term picture – your future self will thank you!

Happy investing!

FREE Property Tool Of The Month!

The FREE Property Tool of The Month is one that may seem basic to start with, but when you realise as an investor, what the banks value your property as, it sometimes more important than what the market does!

So check out the value of that sucker via the Commbank tool below, it gives you an insight into their thoughts around it. Of course a full valuation will give you the best idea, but it’s handy to see what they think.

That’s another Newsletter Wrapped up! Thanks for reading this Aus Property Investors Edition. Let us know your thoughts, share with friends & family to get the word out to the Property Crew! 🔥